Human Capital Financial Statements (HCFS)

For hundreds of years, owners and managers have sought to quantify workforce productivity. This interest has intensified each decade up to the 21st century due to the increasing complexity and sophistication of business, technology, and the workforce. Today, it is imperative to identify and differentiate talent, as companies continue searching for ways to quantify workforce productivity and the differential value that top performers contribute versus average performers. In the past, when most jobs were direct sales or product manufacturing, the workforce was easier to measure via traditional metrics (such as sales per salesperson or number of widgets manufactured per worker).

Keith Hammonds, Fast Company (Why We Hate HR, August 2005)

Measuring and Reporting Human Capital

Introducing Human Capital Financial Statements (HCFS)

These three unique statements provide a wealth of value to companies and investors, as described below:

-

Human Capital Impact Statement - The human capital equivalent or supplement to the income statement, measuring the quarterly or annual impact of human capital on financial performance. This statement measures the workforce impact on financial performance for a given reporting period.

-

Human Capital Asset Statement – Like a balance sheet, this statement quantifies the total value of the workforce, specifically the value of human capital at cost and the total value added over and above cost. It breaks down differential value contributions by job category and can drill down into critical job roles at a micro level to measure the ROI of specific job roles.

-

Human Capital Flow Statement - Similar to a cash flow statement, this schedule traces the flow of human capital across headcount, cost, and movement multiple dimensions by period such as a quarter or year, showing where and how human capital is allocated and used in an organization.

Dr. Jac Fitz-enz - recognized as the father of human capital measurement.

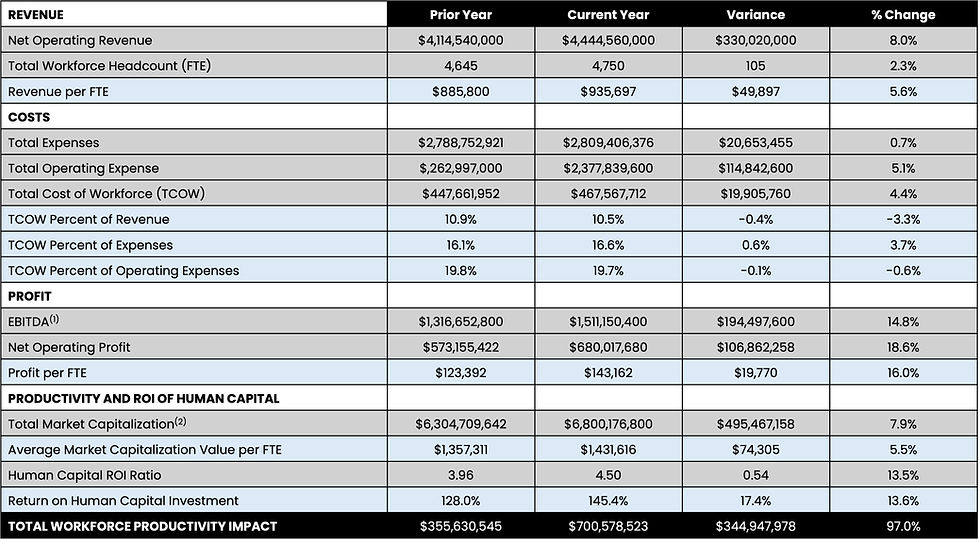

(1) EBITDA = Earnings before interest

(2) Total Market Capitalization for publicly traded organizations or independent bank/financial market valuation for private entities.

Human Capital Financial Statements Answer Many Questions Starting With:

-

What impact does human capital have on financial performance?

-

What is the right number of employees and workforce cost?

-

What is the marginal return of $1.0 invested in the workforce?

-

What is the human capital value creation by different job roles?

-

What is the true cost impact of turnover?

-

Greater transparency into an organization’s stated “most valuable asset,” the workforce, and insight into management effectiveness with that most valuable asset. Transparency into knowledge capital fills a critical gap in today’s disclosure reporting.

-

A method to value knowledge capital. The world of business has changed and it is time that reporting and market disclosures changed with it. The drivers of market valuation today and in the future are far more knowledge capital than financial or physical capital. Today, knowledge capital is classified as intangible capital since no measures exist to make reasonable and accurate valuations. The Human Capital Asset Statement addresses that need. Adoption of the Human Capital Asset Statement can bridge this important gap and give everyone from credit rating agencies, banks, public reporting entities, and individual investors, an objective set of numbers and values with which to make better decisions about the true drivers of value.

-

Improved investment decisions, with better information, mean improved ability to assess future growth, particularly innovation and long-term value creation. This could lead to more efficient and effective deployment of human capital in organizations.

-

Supports standards for human capital reporting and analysis of human capital data for human resources, and the business. The Human Capital Financial Statements actually exceed the Society for Human Resources (SHRM) Human Capital Investor Metrics voluntary reporting standards. Further, these statements provide not just metrics but a methodology and framework with which to show whether the workforce and HR are creating significant value for the organization.

-

Enables benchmarking and comparison of a critical expense and differentiator of success.³ Standards enable deep benchmarking and identify best practices on a broad scale. Today’s benchmarking is often more anecdotal than objective and quantitative.

-

Links financial results to the workforce with both definitive measurement and a contextual story via high-level productivity metrics and quantifiable impact but also by individual talent management life cycle segments (such as recruiting, internal mobility, management, and leadership, training, performance, and engagement, and turnover/retention).

__________________________

³ Benchmarking Standards and Advanced Workforce Measures Provide Insight - For most financial ratio metrics, their primary value is in comparing or benchmarking them with competitors and peers in the same or similar industries, in particular for best-in-class performing organizations. For example, if an organization has an asset return ratio of 3.2 or a return on invested capital of 10%, one often cannot know if those numbers are good unless one knows what competitors and peers have for the same metrics. Improvement is always good however, if competitors are at 4.2, and 18% respectively your organization is in trouble. In short, benchmarking using standardized measures and metrics can be deeply insightful when compared to the proper context and benchmarks.